Elementary schoolers are right in the middle of developing a personal perspective on finance. They are capable of understanding that money is a result of work, that working hard pays off, and that some things are worth saving for.

As parents, it’s up to us to use boundaries, chores, allowances, and that HUGE little word—no—to teach our kids financial responsibility.

Check out the activities below for ideas on how to engage your kid in fun and educational games that teach them the basics on money management. Get ready for some great conversation on your family values regarding money and finance as you have fun together. Here are a few questions to think about as you plan your time together.

- What were taught as a child about money?

- What do you wish you had learned but didn’t?

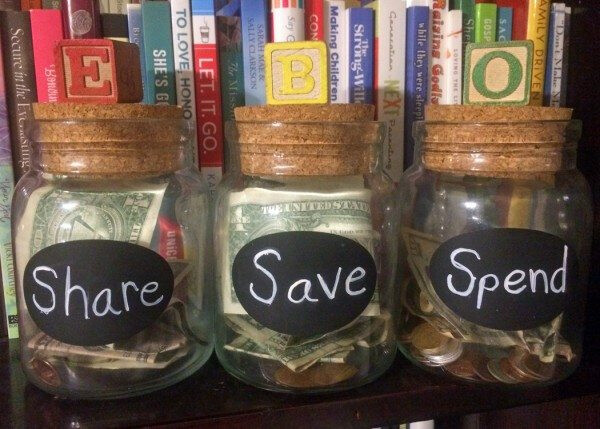

- What are your family values when it comes to giving, saving, and spending?

You can complete these activities in one night, over the course of a week, or repeat them as often as needed.

©2017 The reThink Group, Inc. All rights reserved. • www.parentcue.org

ELEMENTARY SCHOOL EDITION

ACTIVITY 1: MONEY WAR

What You Need:

Cardstock

Coins or images of coins

Tape

Scissors

What You Do:

• Cut the cardstock into 30-40 rectangles of equal size—around the size of a playing card.

• Tape or write various dollar amounts of coins/bills to the cards. (.05, .10, .25, .50, .75, 1.00, 5.00, 10.00)

• Deal the cards facedown until you and your kid both have the same number of cards.

• Play “money war” by flipping over the top cards at the same time. Using some quick math, see whosecard has the higher value. The “winner” gets to keep both cards.

• The player who runs out of cards first, loses.

To end the activity, spend some time talking about the favorite things you and your child like to spend money on. Talk about how much each of these cost and relate it to the cards. (When I buy a latte at Starbucks, it takes one of these $5 cards or 5 of these $1 cards.)

ACTIVITY 2: DOLLAR TRACKER

What You Need:

(1) Poster board (or paper)

Several colors or crayons in multiple colors

What You Do:

• Draw a large dollar sign in the center of the poster board.

• Now, have your elementary-schooler brainstorm all the things money is used for. Think about . . . school supplies, groceries, gymnastics, mortgage/rent, laundry detergent, eating out, gas, shampoo, hair appointments, clothes, doctor visits, etc. You may even want to print out your bank or credit card statement to get ideas.

• Using your list, create a brainstorm “web” using the dollar sign as your base.

• Now, go back and have your kid circle the items that are “needs” in one color and “wants” in another color.

• Using general figures, add up the total monthly costs of the “needs” and the “wants.”

• Discuss the importance of budgeting for the “needs” and saving for the “wants.”

ACTIVITY 3: FAMILY KICKSTARTER

What You Need:

Internet Access

Online spreadsheet or paper and pencil

Optional – art supplies, cardstock, and/or poster board

What You Do:

• Choose an afternoon or evening to sit down with your elementary schooler and plan a potential business.

• Start by making a list of their interests and talents and brainstorm how they could use both to earn money. Maybe your outdoorsy kid can mow lawns. Or your jewelry lover can make bracelets. Or your shopping buddy can find bargains to resell.

• Once you’ve decided on an idea, let the research begin! Gather numbers for how much it would cost to run the business. Take into account gas, supplies, sales tax (where applicable), advertising costs, etc. Come up with a general number for operational costs for one month of business.

• Now create a price list for what they should charge potential customers. Look online for similar retailers or service providers. See how they price their products and services to ensure your rates are competitive.

• Use a spreadsheet to figure out potential profit margins for the business, discussing the importance of hard work, clear communication, and quality products.

• BONUS: Expand the conversation by helping your kid name and create artwork for their business. The two of you could work together to come up with a logo, slogan, or even a few sample flyers or poster boards for marketing.

• BONUS BONUS: Actually start the business or company. You can teach your kid about investment, risk, and reward by setting up a weekly time to meet to develop, start, and maintain your kid’s first business!